Get Quicker Access to Payments from UHC/OPTUM… Is this true?

Is this true from UHC?

To speed up payments to your practice, UnitedHealthcare is phasing out paper checks and moving to digital transactions, where not prohibited by law.

You’ll need to choose between two options for receiving payment from UnitedHealthcare – ACH/direct deposit or virtual card payments. Both of these are facilitated by Optum Pay on behalf of UnitedHealthcare.

If your practice/health care organization is already enrolled and receiving claim payments through ACH/direct deposit, there is no action you need to take.

The California Medical Association (CMA) has learned that UnitedHealthcare (UHC direct pay issue) is in the process of discontinuing physician payments via paper checks and will instead require both contracted and non-contracted physicians to receive payment via automated clearinghouse (ACH)/direct deposit or through virtual credit card payments.

The change, first communicated in UHC’s March 2020 Network Bulletin, was originally planned to be rolled out in phases beginning in mid-2020. Due to the COVID-19 pandemic, the rollout of the program was delayed.

UHC has since announced in its August 2020 Network Bulletin that the program will move forward with a phased rollout beginning with its commercial line of business starting in August 2020. UHC Medicare Advantage and Community and State (Medicaid) Plans will follow with rollouts slated for fall 2020 and early 2021.

UHC will be publicizing the change to both contracted and noncontracted physicians, who will be directed to sign up for ACH/direct deposit through Optum Pay or via the UHCprovider.com/payment website. Physicians who do not elect to sign up for ACH/direct deposit will automatically be signed up to receive virtual credit card payments in place of paper checks.

Physicians with questions or concerns, or that need to request a hardship exemption from this policy, should contact their UHC Provider Service Advocate or UHC at (877) 842-3210 for more information.

What is a virtual credit card?

With the virtual credit card (VCC) payment method, payors send credit card payment information and instructions to physicians, who process the payments using standard credit card technology.

This method is beneficial to payors, but costly for physicians. Health plans often receive cash-back incentives from credit card companies for VCC transactions. Meanwhile, VCC payments are subject to transaction and interchange fees, which are borne by the physician practice and can run as high as 5%per transaction for physician practices. Physicians can avoid these interchange fees by enrolling in ACH/direct deposit.

What to do on the UHC direct pay issue?

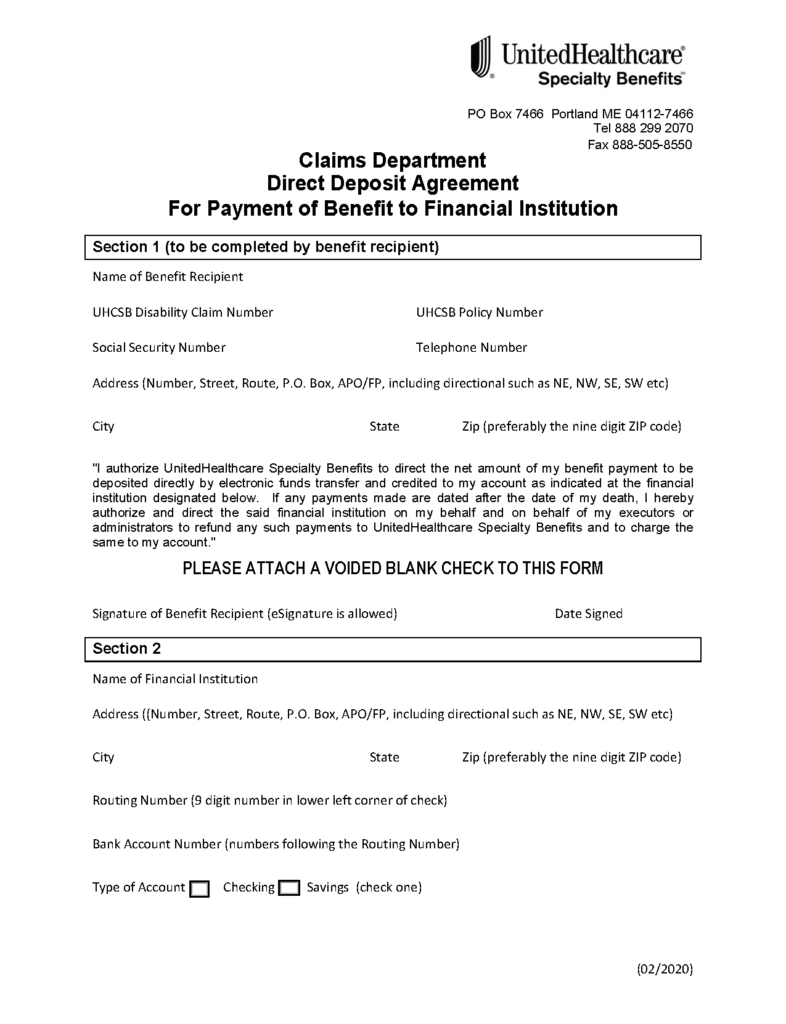

This all depends on the business set up and values of your institution. This can cause major problems for some programs and be slightly beneficial to others. Below is an exert from the specialty benefits form for UHC:

“I authorize UnitedHealthcare Specialty Benefits to direct the net amount of my benefit payment to be deposited directly by electronic funds transfer and credited to my account as indicated at the financial institution designated below. If any payments made are dated after the date of my death, I hereby authorize and direct the said financial institution on my behalf and on behalf of my executors or administrators to refund any such payments to UnitedHealthcare Specialty Benefits and to charge the same to my account.”

The form does not have all the disclaimers that could possibly affect your group/facility or your providers.

Direct Deposit Agreement

For Payment of Benefit to Financial Institution

Here is what UHC says the benefits are for ACH

Automated Clearing House (ACH) /direct deposit

- We recommend ACH because it’s the quickest form of payment available and there are no fees for the service.

- Payments can be routed by both the tax ID number (TIN) and National Provider Identifier (NPI) number level.

- Enrollment generally takes less than 10 minutes. You will need to provide your current bank account information.

- Funds are deposited directly in to your bank account – there are no paper checks or remittance information to lose or misplace.

Here is what UHC says the benefits are for Virtual Card Payment (VCP)

- If you don’t enroll in ACH, in most instances you’ll receive a virtual card payment from Optum Pay. VCPs are electronic payments that use credit card technology to process claim payments. There is no requirement to share bank account information.

- A 16‐digit, single-use virtual card will be issuedopen_in_new for payment (single or multiple claims). You’ll receive a VCP in the mail; for quicker access, you can view the VCP statement in Document Library.

- Each VCP is issued for the full amount of the claim payment. However, VCPs are subject to additional terms and conditions, including fees, between you and your card service processor.

- You can enroll in ACH even after receiving a VCP. However, ACH will only apply to future payments and can’t be applied to previous payments.

We can help navigate if this is something that would benefit any behavioral health institution

A common occurrence with insurance claims is that they are either fluctuating and underpaying or not paying at all. If someone is not

A common occurrence with insurance claims is that they are either fluctuating and underpaying or not paying at all. If someone is not