Revenue Cycle Management 101

Like many other industries, drug rehab and mental health treatment facilities’ financial solvency depends largely on their ability to collect payment in a timely fashion. In order to ensure your receivables are collected in a timely fashion, it is imperative to either have an in-house billing team that runs like a well-oiled machine, or find a stellar third party billing partner.

When it comes to operations in the behavioral health industry, Revenue Cycle Management is not normally the first thing that comes to mind. However, as this industry continues to become more competitive, streamlining your billing operations is crucial. This guide will help outline this process.

Revenue Drivers for Behavioral Health

Hopefully, during the strategic planning of your program, key revenue drivers have been established. These revenue drivers are dependent on your program’s specific type of business model: inpatient or residential vs. outpatient.

There are similarities in foundational revenue drivers in terms of substance abuse and mental health insurance reimbursement. These start even before a potential client steps one foot in the door and can continue long after they are gone:

- Verification of mental health and substance abuse benefits (all levels of care).

- Detailed clinical note taking, proper record keeping, communication between line and clinical staff.

- Billing and submitting claims, payment tracking, client account administration, and denials management (including underpaid and missed claims).

The ability of your program to execute all these tasks in a consistent and efficient manner is directly reated to the amount and timeliness of which you will receive reimbursement.

- Staff-to-client efficiency

- Census level

- Cost of programming

- Claims reimbursement from both Medicaid/Medicare and private health coverage

- Client claims (coinsurance, copayments, deductibles, etc.)

- Collections

These internal drivers are all controllable and can be easily improved upon with some consistent processes and follow-through. Where many organizations struggle is dealing with the more external variables, like collecting from insurance carriers, patients/families, and other payers.

When trying to optimize your revenue cycle, you have to take into consideration the existing setup of private and insurance pay processes. Insurance carriers can take weeks to reimburse stays at behavioral health facilities.

Each individual entity will have their own method of checks and balances to both make sure their policy member is in need of treatment, and how much and how often reimbursements will be paid.

There are many facilities that operate from a dated business model: payment can be made after services have been rendered. Although this approach can help with increasing census, it will end up with longer collection times and ultimately a payment level that equals less than the full cost of care.

Pre-paying and Reimbursements

Claims, claims, claims. There is a reason third party billing exists, and that there are experts within all the different areas of billing. Insurance claims reimbursement—especially for mental health and substance abuse—is not a simple process. It is also an increasing, major portion of a facility’s overall revenue (compared with private cash pay).

- Claims reimbursement starts with proper claims management.

- This process involves meticulous note-taking

- Reimbursement rates negotiation – all levels of care including:

- Inpatient

- Residential Treatment (RTC)

- Partial Hospitalization (PHP)

- Intensive Outpatient (IOP)

- Routine Outpatient (ROP)

The negotiation of contracted rates for behavioral health reimbursement can vary state-by-state and region-by-region. There are different laws and regulations that govern not only how care is administered, but also how it is paid for and reimbursed by insurance carriers.

Navigating these waters is a full-time job in and of itself. If your program does not have room or resources for a dedicated staff member or in-house team, it is best to connect with outside experts.

This includes an organization that is knowledgeable and understands:

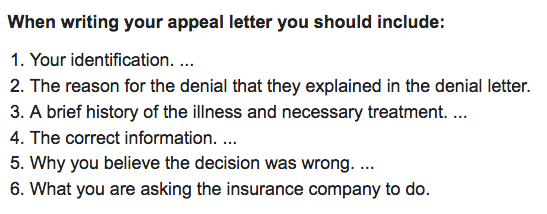

- The lengthy legal appeals process

- The ins and outs of coding

- The subtleties of mental health and addiction language

- Timely filing and follow up

- Quality assurance

A common occurrence with insurance claims is that they are either fluctuating and underpaying or not paying at all. If someone is not watching these claims on a day-to-day basis, it can be difficult to keep your revenue cycle management on point.

A common occurrence with insurance claims is that they are either fluctuating and underpaying or not paying at all. If someone is not watching these claims on a day-to-day basis, it can be difficult to keep your revenue cycle management on point.

A recent in-depth report by 60 Minutes found the claim denial rate often exceeded 90% by Anthem in cases it reviewed.

Even facilities that are running their billing operations as smoothly as possible can still face an uphill battle to keep a solid, timely, and full amount of reimbursements coming in. Rejection rates are going to continue to rise as insurance becomes more and more expensive.

The other factors involved in keeping a solid revenue cycle from insurance reimbursement are the other payables: deductibles, co-pays, and co-insurance. Because of the recent spike in health insurance premiums, there is a correlating rise in people taking on more of the share of the cost. This means that your cash pay collection processes will be put to the test as well.

Collections and Margins

In order for any type of collection to make sense, it has to make cents. It does no good to go after receivables or debts that cost you more to get them then they are worth.

More than likely, the lion’s share of your revenue will come from reimbursement; however, most of the work put into collections will be in getting private pay clients to pay for services rendered.

You have to realize that private health insurance paying for drug rehab or therapeutic boarding schools is a relatively new concept. This option essentially did not exist before the Affordable Care Act was put in place. Because of this, debt collection from insurance reimbursement is now a severe pain point for behavioral health facilities.

For instance, with Blue Cross Blue Shield, all reimbursement checks are sent to the family and not the facility. This creates an additional step in the process, and a huge problem/delay in revenue collection. Because the insurance process is complex and cumbersome, many parents do not realize that the reimbursements they receive are not theirs, and it puts tension on all parties involved.

There was and still is a huge learning curve for proper and diligent insurance billing. In order to maximize allowable amount of reimbursement, it is essential to closely watch the accounts owed for all of the major insurance carriers.

It takes a serious amount of resources, including staff who can:

- Take the time to research insurance trends

- Educate themselves on claims processing for each major carrier (BCBS, Aetna, UBH, Cigna)

- Understand how in-network/out-of-network contracts work

- Apply all this working knowledge to recognizing:

- When to be forceful with outstanding claims

- When to adjust private and insurance pay rates

- Why denials are occurring

A good revenue cycle in this industry should never get beyond 40-50 days.

If there are enough resources allocated to keeping things organized and processes flowing smoothly, this should not be a problem.

To summarize, a facility must streamline:

- Verification of benefits

- Collection of any co-insurance, co-pay, or deductible up front

- Utilization reviews

- Referral management system

- Claims follow-up

- Denials management

The Right Resources for the Right Job

The world of healthcare and healthcare billing is a complex one—a world that, by its very nature, works backwards, and involves extreme delays in payment cycles. Even with these long payment cycles, you should be taking some steps to accelerate the process, or to at least minimize unnecessary delays. Otherwise, an average of 40-50 days for payment can turn into 90-120 days.

Here are some tools you can use:

Roadmap

Think of billing as a chain-linked process. All of those involved with an insurance pay client, including the initial touchpoint, have to understand the entire roadmap from start to finish.

Everyone involved needs to be able to understand what codes will be used, the process of filing a claim, and whether or not their health plan will be a good fit upfront.

Software, The Web, and Being Mobile

- Electronic Health Records

- Client Relationship Management

- HIPAA Compliance

- Mobile Friendly

Knowing these technical terms is instrumental not only in streamlining a facility’s revenue cycle, but also in conducting overall operations. There are many options in the HealthTech world, and which software you want to use will depend on the size and needs of your facility.

Once you choose the correct technologies for your needs, here are some helpful hints to speed up the revenue cycle:

VOB

- Verify insurance online through the carrier portals in order to avoid long call wait times, and be sure to double-check benefits.

Payments

- Collect all insurance payables upfront and offer to reimburse clients after insurance has made payments.

Tracking Patients

- Training therapists and support staff to properly document their client encounters, admissions, and discharges with quick notes and details.

- Make sure clients have primary diagnoses as well as secondary diagnoses if warranted.

Insurance Billing

- Once you have submitted a claim, make sure someone is following up within at least 72 hours to make sure it has been accepted by the clearing house and processed by the carrier.

- Insurance billing reporting will allow you to forecast financials and show trends in health care plans, diagnoses, payment cycles, and much more. Make sure whatever billing software you use has a solid reporting functionality.

This is all easier said than done. It requires a quality team of reliable professionals dedicated to keeping your facility running as efficiently as possible. Your revenue cycle management should be a living, breathing process that is constantly revisited, adapted, and updated. Don’t get complacent!